Transform retail operations with Zebra’s retail technology solutions, featuring hardware and software for improving inventory management and empowering teams.

Streamline operations with Zebra’s healthcare technology solutions, featuring hardware and software to improve staff collaboration and optimize workflows.

Enhance processes with Zebra’s manufacturing technology solutions, featuring hardware and software for automation, data analysis, and factory connectivity.

Zebra’s transportation and logistics technology solutions feature hardware and software for enhancing route planning, visibility, and automating processes.

Learn how Zebra's public sector technology solutions empower state and local governments to improve efficiency with asset tracking and data capture devices.

Zebra's hospitality technology solutions equip your hotel and restaurant staff to deliver superior customer and guest service through inventory tracking and more.

Zebra's market-leading solutions and products improve customer satisfaction with a lower cost per interaction by keeping service representatives connected with colleagues, customers, management and the tools they use to satisfy customers across the supply chain.

Empower your field workers with purpose-driven mobile technology solutions to help them capture and share critical data in any environment.

Zebra's range of Banking technology solutions enables banks to minimize costs and to increase revenue throughout their branch network. Learn more.

Zebra's range of mobile computers equip your workforce with the devices they need from handhelds and tablets to wearables and vehicle-mounted computers.

Zebra's desktop, mobile, industrial, and portable printers for barcode labels, receipts, RFID tags and cards give you smarter ways to track and manage assets.

Zebra's 1D and 2D corded and cordless barcode scanners anticipate any scanning challenge in a variety of environments, whether retail, healthcare, T&L or manufacturing.

Zebra's extensive range of RAIN RFID readers, antennas, and printers give you consistent and accurate tracking.

Choose Zebra's reliable barcode, RFID and card supplies carefully selected to ensure high performance, print quality, durability and readability.

Zebra's location technologies provide real-time tracking for your organization to better manage and optimize your critical assets and create more efficient workflows.

Zebra's rugged tablets and 2-in-1 laptops are thin and lightweight, yet rugged to work wherever you do on familiar and easy-to-use Windows or Android OS.

With Zebra's family of fixed industrial scanners and machine vision technologies, you can tailor your solutions to your environment and applications.

Zebra’s line of kiosks can meet any self-service or digital signage need, from checking prices and stock on an in-aisle store kiosk to fully-featured kiosks that can be deployed on the wall, counter, desktop or floor in a retail store, hotel, airport check-in gate, physician’s office, local government office and more.

Adapt to market shifts, enhance worker productivity and secure long-term growth with AMRs. Deploy, redeploy and optimize autonomous mobile robots with ease.

Discover Zebra’s range of accessories from chargers, communication cables to cases to help you customize your mobile device for optimal efficiency.

Zebra's environmental sensors monitor temperature-sensitive products, offering data insights on environmental conditions across industry applications.

Enhance frontline operations with Zebra’s AI software solutions, which optimize workflows, streamline processes, and simplify tasks for improved business outcomes.

Zebra Workcloud, enterprise software solutions boost efficiency, cut costs, improve inventory management, simplify communication and optimize resources.

Keep labor costs low, your talent happy and your organization compliant. Create an agile operation that can navigate unexpected schedule changes and customer demand to drive sales, satisfy customers and improve your bottom line.

Drive successful enterprise collaboration with prioritized task notifications and improved communication capabilities for easier team collaboration.

Get full visibility of your inventory and automatically pinpoint leaks across all channels.

Reduce uncertainty when you anticipate market volatility. Predict, plan and stay agile to align inventory with shifting demand.

Drive down costs while driving up employee, security, and network performance with software designed to enhance Zebra's wireless infrastructure and mobile solutions.

Explore Zebra’s printer software to integrate, manage and monitor printers easily, maximizing IT resources and minimizing down time.

Make the most of every stage of your scanning journey from deployment to optimization. Zebra's barcode scanner software lets you keep devices current and adapt them to your business needs for a stronger ROI across the full lifecycle.

RFID development, demonstration and production software and utilities help you build and manage your RFID deployments more efficiently.

RFID development, demonstration and production software and utilities help you build and manage your RFID deployments more efficiently.

Zebra DNA is the industry’s broadest suite of enterprise software that delivers an ideal experience for all during the entire lifetime of every Zebra device.

Advance your digital transformation and execute your strategic plans with the help of the right location and tracking technology.

Boost warehouse and manufacturing operations with Symmetry, an AMR software for fleet management of Autonomous Mobile Robots and streamlined automation workflows.

The Zebra Aurora suite of machine vision software enables users to solve their track-and-trace, vision inspection and industrial automation needs.

Zebra Aurora Focus brings a new level of simplicity to controlling enterprise-wide manufacturing and logistics automation solutions. With this powerful interface, it’s easy to set up, deploy and run Zebra’s Fixed Industrial Scanners and Machine Vision Smart Cameras, eliminating the need for different tools and reducing training and deployment time.

Aurora Imaging Library™, formerly Matrox Imaging Library, machine-vision software development kit (SDK) has a deep collection of tools for image capture, processing, analysis, annotation, display, and archiving. Code-level customization starts here.

Aurora Design Assistant™, formerly Matrox Design Assistant, integrated development environment (IDE) is a flowchart-based platform for building machine vision applications, with templates to speed up development and bring solutions online quicker.

Designed for experienced programmers proficient in vision applications, Aurora Vision Library provides the same sophisticated functionality as our Aurora Vision Studio software but presented in programming language.

Aurora Vision Studio, an image processing software for machine & computer vision engineers, allows quick creation, integration & monitoring of powerful OEM vision applications.

Adding innovative tech is critical to your success, but it can be complex and disruptive. Professional Services help you accelerate adoption, and maximize productivity without affecting your workflows, business processes and finances.

Zebra's Managed Service delivers worry-free device management to ensure ultimate uptime for your Zebra Mobile Computers and Printers via dedicated experts.

Find ways you can contact Zebra Technologies’ Support, including Email and Chat, ask a technical question or initiate a Repair Request.

Zebra's Circular Economy Program helps you manage today’s challenges and plan for tomorrow with smart solutions that are good for your budget and the environment.

The Zebra Knowledge Center provides learning expertise that can be tailored to meet the specific needs of your environment.

Zebra has a wide variety of courses to train you and your staff, ranging from scheduled sessions to remote offerings as well as custom tailored to your specific needs.

Build your reputation with Zebra's certification offerings. Zebra offers a variety of options that can help you progress your career path forward.

Build your reputation with Zebra's certification offerings. Zebra offers a variety of options that can help you progress your career path forward.

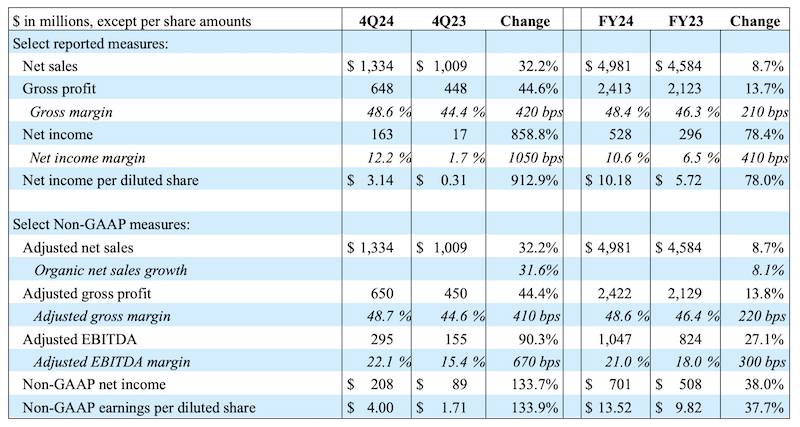

Zebra Technologies Announces Fourth-Quarter and Full-Year 2024 Results

Fourth-Quarter Financial Highlights

- Net sales of $1,334 million; year-over-year increase of 32.2%

- Net income of $163 million and net income per diluted share of $3.14, year-over-year increase of 858.8% and 912.9%, respectively

- Non-GAAP diluted EPS increased 133.9% year-over-year to $4.00

- Adjusted EBITDA increased 90.3% year-over-year to $295 million

Lincolnshire, Ill., February 13, 2025 — Zebra Technologies Corporation (NASDAQ: ZBRA), a global leader in digitizing and automating frontline workflows, today announced results for the fourth quarter and full year ended December 31, 2024.

“Our teams executed well, delivering results that exceeded our outlook. Strong year-end spending by our North American retail customers drove our fourth quarter outperformance,” said Bill Burns, Chief Executive Officer of Zebra Technologies. “As we enter 2025, our backlog supports solid first quarter growth. For the remainder of the year, we remain cautious in our growth outlook as our customers navigate an uncertain environment including a dynamic global trade, geopolitical, and macro-economic backdrop. We remain well positioned to drive sustainable profitable growth while extending our lead in the industry with innovative solutions that digitize and automate workflows across the supply chain."

Download PDF with consolidated balance sheet, cash flow and income statements

Net sales were $1,334 million in the fourth quarter of 2024 compared to $1,009 million in the prior year. Net sales in the Enterprise Visibility & Mobility ("EVM") segment were $886 million in the fourth quarter of 2024 compared to $663 million in the prior year. Asset Intelligence & Tracking ("AIT") segment net sales were $448 million in the fourth quarter of 2024 compared to $346 million in the prior year. Consolidated organic net sales for the fourth quarter of 2024 increased 31.6% year over year, with a 33.1% increase in the EVM segment and 28.8% increase in the AIT segment.

Fourth-quarter 2024 gross profit was $648 million compared to $448 million in the prior year. Gross margin increased to 48.6% for the fourth quarter of 2024 compared to 44.4% in the prior year. The increase was primarily due to volume leverage. Adjusted gross margin was 48.7% in the fourth quarter of 2024, compared to 44.6% in the prior year.

Operating expenses increased in the fourth quarter of 2024 to $423 million from $374 million in the prior year primarily due to higher employee incentive compensation associated with financial performance and increased investments in the business. Adjusted operating expenses increased in the fourth quarter of 2024 to $373 million from $312 million in the prior year.

Net income for the fourth quarter of 2024 was $163 million, or $3.14 per diluted share, compared to net income of $17 million, or $0.31 per diluted share, in the prior year. Non-GAAP net income for the fourth quarter of 2024 increased to $208 million, or $4.00 per diluted share, compared to $89 million, or $1.71 per diluted share, in the prior year.

Adjusted EBITDA for the fourth quarter of 2024 increased to $295 million, or 22.1% of adjusted net sales, compared to $155 million, or 15.4% of adjusted net sales, in the prior year due to higher gross profit and lower operating expense as a percentage of adjusted net sales.

Balance Sheet and Cash Flow

As of December 31, 2024, the company had cash and cash equivalents of $901 million and total debt of $2,183 million.

For the full year 2024, net cash provided by operating activities was $1,013 million and the Company made capital expenditures of $59 million, resulting in free cash flow of $954 million. The Company made share repurchases under its existing authorization of $47 million and had net debt payments of $43 million.

Outlook

First Quarter 2025

The company expects net sales to grow between 8% and 11% compared to the first quarter of 2024. This expectation includes an approximately 1 point unfavorable impact from foreign currency translation.

Adjusted EBITDA margin for the first quarter of 2025 is expected to be approximately 21%, which includes approximately $7 million gross profit impact from recently announced Mexico and China import tariffs. Non-GAAP diluted earnings per share are expected to be in the range of $3.50 to $3.70.

Full Year 2025

The Company expects net sales to grow between 3% to 7% compared to 2024. This expectation assumes a 130 basis point unfavorable impact from foreign currency translation.

Adjusted EBITDA margin is expected to be between 21% and 22%, which includes approximately $20 million gross profit impact from recently announced Mexico and China import tariffs net of planned mitigation actions. Non-GAAP diluted earnings per share are expected to be the range of $14.75 to $15.25. This assumes an adjusted effective tax rate of approximately 17%.

Free cash flow is expected to be at least $750 million.

This outlook does not include any projected results from the previously announced acquisition of Photoneo, which is expected to close during the first quarter of 2025.

The Company does not provide a reconciliation for non-GAAP estimates on a forward-looking basis where it is unable to provide a meaningful or accurate calculation or estimation of reconciling items and the information is not available without unreasonable effort. This is due to the inherent difficulty of forecasting the timing or amount of the most directly comparable forward-looking GAAP financial measure as discussed under the "Forward-Looking Statements" caption below. This would include items that have not yet occurred, are out of the Company’s control and/or cannot be reasonably predicted, and that would impact diluted net earnings per share. For the same reasons, the Company is unable to address the probable significance of the unavailable information. Forward-looking non-GAAP financial measures provided without the most directly comparable GAAP financial measures may vary materially from the corresponding GAAP financial measures.

Conference Call Notification

Investors are invited to listen to a live webcast of Zebra’s conference call regarding the company’s financial results. The conference call will be held today at 7:30 a.m. Central Time (8:30 a.m. Eastern Time). To view the webcast, visit the investor relations section of the company’s website at investors.zebra.com.

About Zebra

Zebra (NASDAQ: ZBRA) provides the tools to help businesses grow with asset visibility, connected frontline workers and intelligent automation. The company operates in more than 100 countries, and our customers include over 80% of the Fortune 500. Designed for the frontline, Zebra’s award-winning portfolio includes hardware, software, and services, all backed by our 50+ year legacy and global partner ecosystem. Follow Zebra on our blog and LinkedIn, visit our newsroom and learn more at www.zebra.com.

Forward-Looking Statements

This press release contains forward-looking statements, as defined by the Private Securities Litigation Reform Act of 1995, including, without limitation, the statements regarding the company’s outlook. Actual results may differ from those expressed or implied in the company’s forward-looking statements. These statements represent estimates only as of the date they were made. Zebra undertakes no obligation, other than as may be required by law, to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changed circumstances or any other reason after the date of this release.

These forward-looking statements are based on current expectations, forecasts and assumptions and are subject to the risks and uncertainties inherent in Zebra’s industry, market conditions, general domestic and international economic conditions, and other factors. These factors include customer acceptance of Zebra’s offerings and competitors' offerings, and the potential effects of emerging technologies and changes in customer requirements. The effect of global market conditions, and the availability of credit and capital markets volatility may have adverse effects on Zebra, its suppliers and its customers. In addition, natural disasters, man-made disasters, public health issues (including pandemics), and cybersecurity incidents may have negative effects on Zebra's business and results of operations. Zebra's ability to purchase sufficient materials, parts, and components, and ability to provide services, software and products to meet customer demand could negatively impact Zebra's results of operations and customer relationships. Profits and profitability will be affected by Zebra’s ability to control manufacturing and operating costs. Because of its debt, interest rates and financial market conditions may also have an adverse impact on results. Foreign exchange rates, customs duties and trade policies may have an adverse effect on financial results because of the large percentage of Zebra's international sales. The impacts of changes in foreign and domestic governmental policies, regulations, or laws, as well as the outcome of litigation or tax matters in which Zebra may be involved are other factors that could adversely affect Zebra's business and results of operations. The success of integrating acquisitions could also adversely affect profitability, reported results and the company’s competitive position in its industry. These and other factors could have an adverse effect on Zebra’s sales, gross profit margins and results of operations and increase the volatility of Zebra's financial results. When used in this release and documents referenced, the words “anticipate,” “believe,” “outlook,” and “expect” and similar expressions, as they relate to the company or its management, are intended to identify such forward-looking statements, but are not the exclusive means of identifying these statements. Descriptions of certain risks, uncertainties and other factors that could adversely affect the company’s future operations and results can be found in Zebra’s filings with the Securities and Exchange Commission, including the company’s most recent Form 10-K and Form 10-Q.

Use of Non-GAAP Financial Information

This press release contains certain Non-GAAP financial measures, consisting of “Adjusted EBITDA,” “Adjusted EBITDA margin,” “Adjusted EBITDA % of adjusted net sales,” “adjusted gross margin,” “adjusted gross profit,” “adjusted net sales,” “adjusted operating expenses,” “EBITDA,” “free cash flow,” “non-GAAP diluted earnings per share,” “non-GAAP earnings per share,” “non-GAAP net income,” “organic net sales,” and “organic net sales growth (decline).” Management presents these measures to focus on the on-going operations and believes it is useful to investors because they enable them to perform meaningful comparisons of past and present operating results. The company believes it is useful to present non-GAAP financial measures, which exclude certain significant items, as a means to understand the performance of its ongoing operations and how management views the business. Please see the “Reconciliation of GAAP to Non-GAAP Financial Measures” tables and accompanying disclosures at the end of this press release for more detailed information regarding non-GAAP financial measures herein, including the items reflected in adjusted net earnings calculations. These measures, however, should not be construed as an alternative to any other measure of performance determined in accordance with GAAP.

The company does not provide a reconciliation for non-GAAP estimates on a forward-looking basis (including the information under “Outlook” above) where it is unable to provide a meaningful or accurate calculation or estimation of reconciling items and the information is not available without unreasonable effort. This is due to the inherent difficulty of forecasting the timing or amount of various items that have not yet occurred, are out of the company’s control and/or cannot be reasonably predicted, and that would impact diluted net earnings per share, the most directly comparable forward-looking GAAP financial measure. For the same reasons, the company is unable to address the probable significance of the unavailable information. Forward-looking non-GAAP financial measures provided without the most directly comparable GAAP financial measures may vary materially from the corresponding GAAP financial measures.

As a global company, Zebra's operating results reported in U.S. dollars are affected by foreign currency exchange rate fluctuations because the underlying foreign currencies in which the company transacts change in value over time compared to the U.S. dollar; accordingly, the company presents certain organic growth financial information, which includes impacts of foreign currency translation, to provide a framework to assess how the company’s businesses performed excluding the impact of foreign currency exchange rate fluctuations. Foreign currency impact represents the difference in results that are attributable to fluctuations in the currency exchange rates used to convert the results for businesses where the functional currency is not the U.S. dollar. This impact is calculated by translating current period results at the currency exchange rates used in the comparable prior year period as well as removing realized cash flow hedge gains and losses from both the current and prior year periods. The company believes these measures should be considered a supplement to and not in lieu of the company’s performance measures calculated in accordance with GAAP.

Contacts

Investors

Michael Steele, CFA, IRC

Vice President, Investor Relations

Phone: + 1 847 518 6432

InvestorRelations@Zebra.com

Media

Therese Van Ryne

Senior Director, External Communications

Phone: + 1 847 370 2317

therese.vanryne@zebra.com

Legal Terms of Use Privacy Policy Supply Chain Transparency

ZEBRA and the stylized Zebra head are trademarks of Zebra Technologies Corp., registered in many jurisdictions worldwide. All other trademarks are the property of their respective owners. ©2025 Zebra Technologies Corp. and/or its affiliates.