Transform retail operations with Zebra’s retail technology solutions, featuring hardware and software for improving inventory management and empowering teams.

Streamline operations with Zebra’s healthcare technology solutions, featuring hardware and software to improve staff collaboration and optimise workflows.

Enhance processes with Zebra’s manufacturing technology solutions, featuring hardware and software for automation, data analysis, and factory connectivity.

Zebra’s transportation and logistics technology solutions feature hardware and software for enhancing route planning, visibility, and automating processes.

Zebra's public sector technology solutions enhance decision-making, streamline operations, and safeguard communities with advanced software and rugged hardware.

Zebra's hospitality technology solutions equip your hotel and restaurant staff to deliver superior customer and guest service through inventory tracking and more.

Zebra's market-leading solutions and products improve customer satisfaction with a lower cost per interaction by keeping service representatives connected with colleagues, customers, management and the tools they use to satisfy customers across the supply chain.

Empower your field workers with purpose-driven mobile technology solutions to help them capture and share critical data in any environment.

Zebra's range of mobile computers equip your workforce with the devices they need from handhelds and tablets to wearables and vehicle-mounted computers.

Zebra's desktop, mobile, industrial, and portable printers for barcode labels, receipts, RFID tags and cards give you smarter ways to track and manage assets.

Zebra's 1D and 2D corded and cordless barcode scanners anticipate any scanning challenge in a variety of environments, whether retail, healthcare, T&L or manufacturing.

Zebra's extensive range of RAIN RFID readers, antennas, and printers give you consistent and accurate tracking.

Choose Zebra's reliable barcode, RFID and card supplies carefully selected to ensure high performance, print quality, durability and readability.

Zebra's location technologies provide real-time tracking for your organisation to better manage and optimise your critical assets and create more efficient workflows.

Zebra's rugged tablets and 2-in-1 laptops are thin and lightweight, yet rugged to work wherever you do on familiar and easy-to-use Windows or Android OS.

With Zebra's family of fixed industrial scanners and machine vision technologies, you can tailor your solutions to your environment and applications.

Zebra’s line of kiosks can meet any self-service or digital signage need, from checking prices and stock on an in-aisle store kiosk to fully-featured kiosks that can be deployed on the wall, counter, desktop or floor in a retail store, hotel, airport check-in gate, physician’s office, local government office and more.

Discover Zebra’s range of accessories from chargers, communication cables to cases to help you customise your mobile device for optimal efficiency.

Zebra's environmental sensors monitor temperature-sensitive products, offering data insights on environmental conditions across industry applications.

Adapt to market shifts, enhance worker productivity and secure long-term growth with AMRs. Deploy, redeploy and optimize autonomous mobile robots with ease.

Enhance frontline operations with Zebra’s AI software solutions, which optimize workflows, streamline processes, and simplify tasks for improved business outcomes.

Zebra Workcloud, enterprise software solutions boost efficiency, cut costs, improve inventory management, simplify communication and optimize resources.

Keep labour costs low, your talent happy and your organisation compliant. Create an agile operation that can navigate unexpected schedule changes and customer demand to drive sales, satisfy customers and improve your bottom line.

Drive successful enterprise collaboration with prioritized task notifications and improved communication capabilities for easier team collaboration.

Get full visibility of your inventory and automatically pinpoint leaks across all channels.

Reduce uncertainty when you anticipate market volatility. Predict, plan and stay agile to align inventory with shifting demand.

Drive down costs while driving up employee, security, and network performance with software designed to enhance Zebra's wireless infrastructure and mobile solutions.

Explore Zebra’s printer software to integrate, manage and monitor printers easily, maximising IT resources and minimising down time.

Make the most of every stage of your scanning journey from deployment to optimisation. Zebra's barcode scanner software lets you keep devices current and adapt them to your business needs for a stronger ROI across the full lifecycle.

RFID development, demonstration and production software and utilities help you build and manage your RFID deployments more efficiently.

RFID development, demonstration and production software and utilities help you build and manage your RFID deployments more efficiently.

Zebra DNA is the industry’s broadest suite of enterprise software that delivers an ideal experience for all during the entire lifetime of every Zebra device.

Advance your digital transformation and execute your strategic plans with the help of the right location and tracking technology.

Boost warehouse and manufacturing operations with Symmetry, an AMR software for fleet management of Autonomous Mobile Robots and streamlined automation workflows.

The Zebra Aurora suite of machine vision software enables users to solve their track-and-trace, vision inspection and industrial automation needs.

Zebra Aurora Focus brings a new level of simplicity to controlling enterprise-wide manufacturing and logistics automation solutions. With this powerful interface, it’s easy to set up, deploy and run Zebra’s Fixed Industrial Scanners and Machine Vision Smart Cameras, eliminating the need for different tools and reducing training and deployment time.

Aurora Imaging Library™, formerly Matrox Imaging Library, machine-vision software development kit (SDK) has a deep collection of tools for image capture, processing, analysis, annotation, display, and archiving. Code-level customisation starts here.

Aurora Design Assistant™, formerly Matrox Design Assistant, integrated development environment (IDE) is a flowchart-based platform for building machine vision applications, with templates to speed up development and bring solutions online quicker.

Designed for experienced programmers proficient in vision applications, Aurora Vision Library provides the same sophisticated functionality as our Aurora Vision Studio software but presented in programming language.

Aurora Vision Studio, an image processing software for machine & computer vision engineers, allows quick creation, integration & monitoring of powerful OEM vision applications.

Adding innovative tech is critical to your success, but it can be complex and disruptive. Professional Services help you accelerate adoption, and maximise productivity without affecting your workflows, business processes and finances.

Zebra's Managed Service delivers worry-free device management to ensure ultimate uptime for your Zebra Mobile Computers and Printers via dedicated experts.

Find ways you can contact Zebra Technologies’ Support, including Email and Chat, ask a technical question or initiate a Repair Request.

Zebra's Circular Economy Program helps you manage today’s challenges and plan for tomorrow with smart solutions that are good for your budget and the environment.

Retail Inflation is Soaring—Now What?

Anyone who’s purchased anything over the past 8-12 months—from a can of tuna to a new SUV—has shared a universal lament: almost everything seems to be getting more expensive. As of this past March, the Consumer Price Index (CPI), the U.S. government’s yardstick for tracking inflation, reported an April figure of 8.3%—a nominal .3 drop from the previous month’s 40-year high.

Inflation of course is nothing new—it’s been an element of economics forever. Some of us are old enough to remember (albeit vaguely) President Ford’s 1974 ‘WIN’ campaign, when wearing a red lapel button, pledging household frugality and general optimism represented a national strategy to “Whip Inflation Now” as the CPI raged over 11%. The “WIN” campaign would ultimately fall far short of Ford’s goal.

Many economists will concede some level of regular inflation—around 2% annually—is actually necessary to promote consumption and keep the money supply moving. The government can attempt to encourage “good inflation” by printing more money, though that approach can often be too successful and raise prices too steeply. Externally, inflation is a mismatch of supply and demand that can be classified into two categories:

Cost-push—Retail prices rise because of higher costs of obtaining raw materials or delivering a service.

Demand-pull—When consumer demand for an item or service outpaces its availability in the marketplace.

In large measure, today’s sharp spike of inflation—both cost and demand—was accelerated by the latter stages of the pandemic:

Americans who lost their jobs in the early stages of the pandemic are increasingly returning to work, with June’s unemployment rate holding steady at 3.6%. The newly re-employed are rapidly pumping their new wages back into the economy.

Those who were fortunate to avoid the unemployment line – but remained cautious in their spending habits – are now anxious to loosen up their pocketbooks, catching up on major purchases, travel, or refreshing their wardrobes after two years cooped up at home.

Federal stimulus checks and other government aid dispersed at the height of the pandemic may have eventually contributed as much as an additional three percentage points to the CPI, per Federal Reserve estimates, outpacing inflation in the rest of the world.

Meanwhile, the much-reported worldwide shipping slowdown, manual labor shortage and other nagging supply chain bottlenecks continue to prevent manufacturers and retailers from delivering enough inventory to meet the pent-up customer demand.

And then came Russia’s invasion of Ukraine—bringing overnight economic sanctions that would throw global oil markets into a frenzy, quickly raising fuel prices and, subsequently, sending logistics costs for most consumer goods upward.

This historic double-whammy of world events prompted the Federal Reserve to attempt to pump the brakes on inflation by raising interest rates three quarters of a percentage point in July – the largest hike in over two decades and the third increase this year—while hinting similar incremental hikes could be on the horizon. Unfortunately, such “bitter medicine” from the Fed can bring harsh side effects—a volatile stock market, in particular—as these adjustments work toward wrangling inflation back under control.

How does all this affect the immediate future of retailing?

It means that pricing optimization strategies are more important than ever in that eternal juggling act: efficiently moving inventory and achieving sustainable margins, while not raising prices to the point of driving away customers and sacrificing market share. A recent report released by RSR Research reveals 80% of surveyed retailers consider pricing optimization “very important.”

For many retailers, margins are bottlenecked because they’re still bound to a reactive pricing structure. They manually wrangle antiquated, one-dimensional spreadsheets—churning last year’s sales data to make “best guestimates” on future pricing and markdowns, then resorting to ad hoc markdowns to resolve gluts of SKUs. Or they take a wait-and-see approach based on what competitors do.

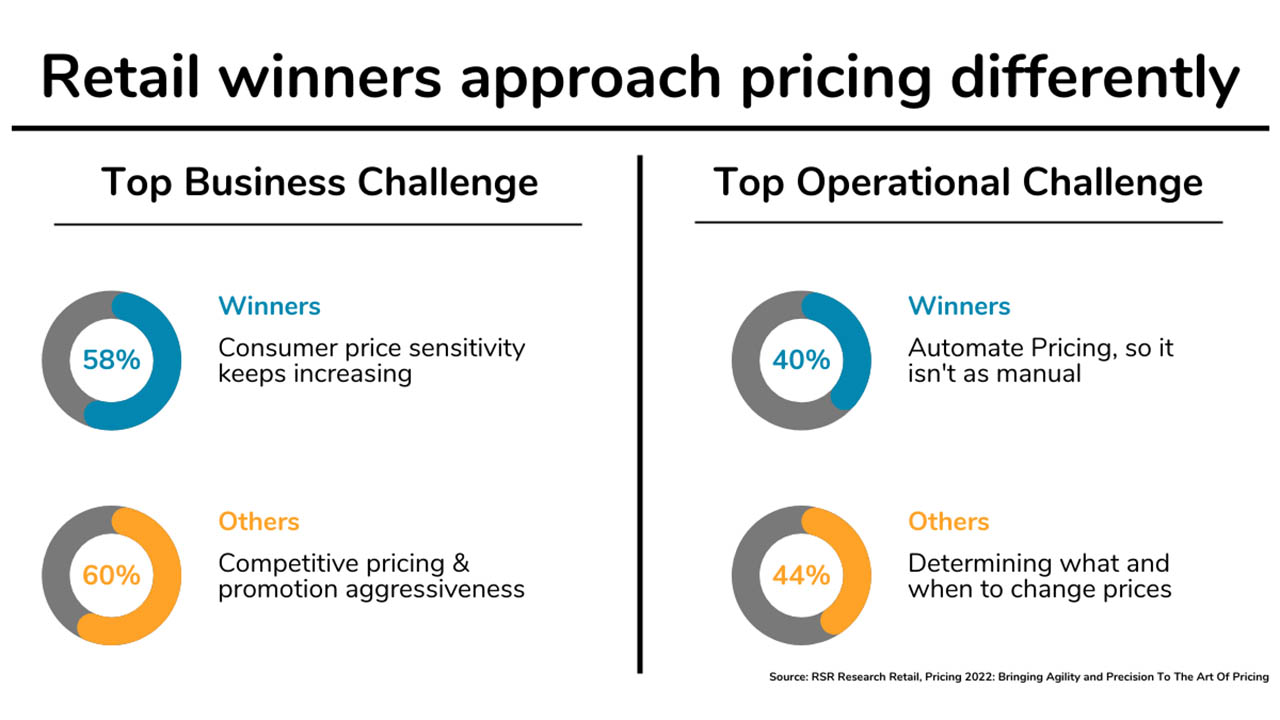

By contrast, an overwhelming percentage of retailers who regularly out-perform their vertical competition—what RSR classifies as “retail winners”—are reaping the benefits of AI and machine learning solutions, leveraging predictive analytics to spearhead a proactive pricing strategy.

In this ever-competitive, inflation-influenced marketplace, AI-driven data science is proving more valuable than ever. RSR’s research highlights that retail winners focus their concerns on consumers, while others are overly worried about their competitors’ pricing moves. In addition, winners consider their primary challenge to be automating their pricing decisions, while others indicated shifting to optimized price points at the right times would be a key benefit.

The time-saving automation of AI delivers multiple accurate, actionable forecasts across several fronts:

Price points which will facilitate the most efficient sell-through in real-world conditions.

Agile inventory distribution—the right quantities, at the right store locations, at the right times.

When and where targeted promotions will be most effective.

Markdown optimization—achieving maximized margins before items are sent to the clearance rack.

Additional RSR research indicates a whopping 82% of winners deem AI tools “essential.” By contrast, only 56% of non-winners share the same opinion. Even more surprising, 42% of that same group view AI tools as only a “nice to have” or luxury feature, despite two-plus years of rapid change, labor churns and shortages, and other economic volatility.

At the outset of the pandemic, many retailers scrambled to divert their IT resources toward bolstering their omnichannel fulfillment infrastructure to get online orders out the door. Today, in a tightening economy buffeted by sharp inflation – with no end yet in sight – every retailer is on the lookout for any proactive advantage they can find to drive growth, profits, and customer loyalty. Now is a great time to take a fresh look at AI-powered lifecycle pricing solutions.

###

Related Reads

David Barach

David Barach is currently a Senior Director for Retail Software Solution Strategy supporting the overall product content, positioning and adoption for antuit.ai’s suite of merchandising solutions for retailers. antuit.ai was recently acquired by Zebra Technologies.

Previously, he has worked for 20 years in the retail solutions space in Pricing, Planning and Inventory Optimization solutions for 84.51 (Kroger Co,), SAS Institute, DemandTec (now IBM), ProfitLogic (now Oracle) and Spotlight Solutions. Prior to the solution space, he worked for 15 years in store, planning and pricing roles for Target Corp, Mercantile Stores and Macy’s Department Stores. He has an MBA from Memphis State University and BA from Vanderbilt University.

Zebra Developer Blog

Zebra Developer Blog

Are you a Zebra Developer? Find more technical discussions on our Developer Portal blog.

Zebra Story Hub

Zebra Story Hub

Looking for more expert insights? Visit the Zebra Story Hub for more interviews, news, and industry trend analysis.

Search the Blog

Search the Blog

Use the below link to search all of our blog posts.

Most Recent

Legal Terms of Use Privacy Policy Supply Chain Transparency

ZEBRA and the stylized Zebra head are trademarks of Zebra Technologies Corp., registered in many jurisdictions worldwide. All other trademarks are the property of their respective owners. ©2025 Zebra Technologies Corp. and/or its affiliates.